There are factors that make any trader successful and they all boils down to Trading Psychology, learning from your own experiences and from others’ mistakes and success stories that guide your own decision making processes.

See this….

“My dear Nina: Can’t help it. Things have been bad with me. I am tired of fighting. Can’t carry on any longer. This is the only way out. I am unworthy of your love. I am a failure. I am truly sorry, but this is the only way out for me. Love Laurie.”

-jesse LIVERMORE

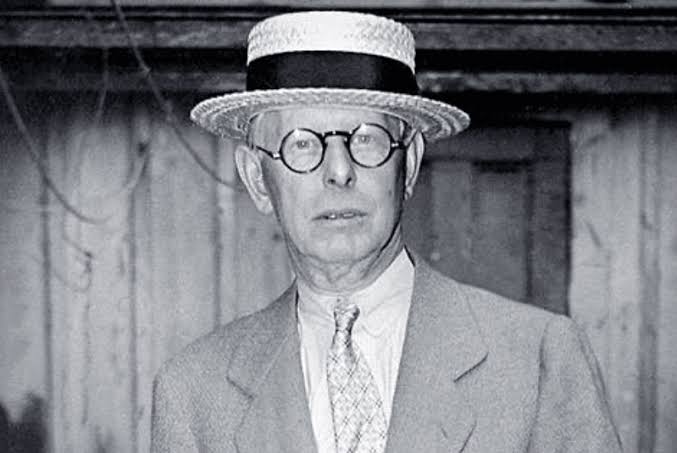

That was the suicide note of the 8 small handwriting pages of Jesse Livermore found in his personal leather-bound notebook.

He wrote it to his wife named Harriet that he nicknamed “Nina”.

- Introduction To Trading Psychology

- What is Trading?

- What is Psychology in a layman's Language?

- What do you understand by Trading Psychology?

- Early History of Jesse Livermore – His Humble Beginning!

- How Livermore Started His Career As a Trader – His First Profits!

- Livermore Received The Image of a mini god – He Got Banned!

- The Beginning Of Livermore's Greater Fortune

- The Beginning Of Livermore's Downfall

- Livermore Once Had a Fighting Spirit and He Exercised it Here!

- How Personal Issues Can Affect Your Trading Business

- Tragic End Of The Legend Jesse Livermore – Result of Negative Trading Psychology

- Lessons Derived From This Article and The Legend Jesse Livermore's Story

- Conclusion – All in One View About Trading Psychology!

Introduction To Trading Psychology

In few minutes, I would work you through a short story of Jesse Livermore and show you his biggest mistakes and more that led to his suicide.

I would also show you how you can avoid his pitfalls and have the potentials of becoming successful at trading as he was. But..

Before we begin, I need to call your attention to one most important factor necessary for you to understand the story and the underlying principles.

It would also enable you to get the hidden lessons of Livermore story the way I have it carved out for you.

Before we delve into the whole topic, permit me to introduce to you some terms you would see along in this article.

Ready? Okay fasten your belt, we’re about to take off! 1, 2,…GO!

Let’s shoot..

What is Trading?

I don’t want to assume you know what trading means if this is your first time of reading about trading and all these interesting jargons!

So, here is what it means…

Trading is the art of buying and selling of assets or exchange of goods and services.

If you have ever exchanged something with your friend to receive another valuable item that worths the one you exchange or almost the same value, then you’ve also traded.

Remember trade by barta done by our fore fathers in the stone age or before/after then?

When they exchanged some tubers of yam or bucket of tomatoes for a basket of pepper. Or…

Exchange of clothes for jewellries and many more. All these actions are regarded as trading and the participants involved are known as Traders.

Note the next thing…

Trading doesn’t include someone donating a huge amount of money to a charity. No! Because, there is no exchange of value.

Got the idea now?

And trading in this regard involves buying and selling of assets like Cryptocurrencies, forex, bonds, stocks etc.

Assets are anything you buy that has potentials of bringing money into your pocket, wallet or bank account!

Our fore fathers might not know what this was called then or they had no idea of what they were doing. But..

If you want to know more on this, I have explained in details the types of traders we have in Crypto Trading and more which you can find in this article.

Let’s proceed…

Before I demistify it for you, it’s important I explain the word Psychology itself in a layman’s language

What is Psychology in a layman’s Language?

The word Psychology itself, deals with the study of all processes and ways you as a human being use your mind to think and take actions especially on the ones affecting your behaviors in the market before, during and after trading!

Are you getting the idea now? Okay, stay with me..

Now, to the main topic, what is Trading Psychology?

What do you understand by Trading Psychology?

Can you combine the two seperate terms above together now and come up with your own definition?

Okay chill, let’s do it together!

“Trading Psychology according to Investopedia is defined as the emotions and mental state that help to dictate success or failure in trading securities.”

-Investopedia

Securities here could also be replaced with any financial instrument i.e Bonds, Stocks, Cryptocurrency/Forex.

This means any emotion or anything that influences your trading decisions either your internal factors(like greed, fear, hope, happiness etc) or..

External factors like the news, FUD(Fear, Uncertainty, Doubt), influencers, and advice of other traders, etc or..

Other factors due to your own trading experiences, knowledge, skills that contribute to your failure or success are all regarded as Trading Psychology.

Furthermore, Trading Psychology in this regard shows how you receive some set of data, how you use your mind to process it and turning it into an informed decision (either good or bad) before you carry it out which determines your profits or losses as outcomes in the market.

This means that, your success or failures in the market is majorly determined by the way you think or…

Let me say, by what you allow into your mind which you believe and turn into a system which you act on.

This will make me share the short story of one the legends in the trading space with you next.

Stay with me…

By the end of this article, you would have adequate knowledge and armed to the teeth with the lessons that guide you towards the right Trading Psychology and being able to avoid the negative ones in your trading journey.

Let’s begin…

Early History of Jesse Livermore – His Humble Beginning!

Jesse Lauriston Livermore was born on the 26th of July 1877 in Shrewsbury, Massachusetts. His father was a farmer and his mother was a home maker.

Livermore learned to read and write at the age of three and half and by the age of five(5), he already started reading the financial newspapers!

Keep following the story..

Fast forward…

How Livermore Started His Career As a Trader – His First Profits!

Livermore started his career as a chalk boy where he worked to attend to customers who came to the brokerage firm where he worked.

But, while he was at this job, he was already gathering some knowledge, and one day he decided to start using his ideas of numbers as a chalk boy to participate at the bucket shop. Guess what?

His ideas made him 3 dollars profits at first attempt and sooner he was making more profits than he was making in his day job which made him quit his job like any other smart person would do right?

By the age of fifteen(15), Livermore has made $1,000 from trading at the bucket shop which actually worths more than $25,000 in today’s value all by his own trading systems he developed.

But something interesting happened…

Livermore Received The Image of a mini god – He Got Banned!

While Livermore was having fun making cool profits, all the bucket shops started noticing him and his consistency in winnings.

So, they assumed he was a god or different human being entirely! This assumption made them banned him from being a participant in his own town! Lol..

Interesting right? Okay read the next sentence…

By the age of twenty(20), Livermore had made over $10,000 and he moved to the New York Stock Exchange where he continued his trading career but…

At some point, his money reduced from over $10,000 to around $2,500 in Boston. Can you guess why?

Just because he couldn’t stick to his own trading strategies/systems that always worked for him.

Even though, he said the system worked about 70% win rate but just like you or many traders do today, he couldn’t just stick to it!

After that, he resumed to trading in New York with his remaining $2,500. And ofcourse, he became a famous winning Trader as he did in Boston but..

He couldn’t hold this position for long as he lost all his money again! Wanna guess why this time?

Okay, here is it…

He realised that, his systems of bucket shops wasn’t meant for the stock exchange market!

I guess power changed hands! Lol…

So, Livermore went back to village!(Jokes)

Livermore went back to the bucket shops but this time, he sent other people to play on his behalf since all the shops knew him as a mini god!

He did this for a while till he could raise money to start trading back. After this, he had another fantastic fame!

Here’s where it gets interesting…

Jesse Livermore became a more famous trader when he made $1,000,000(1 Million Dollar) in a day just by SHORTING the market during a time of FUD as we do have it in BTC market today!

He actually made upto $3,000,000(3 Million Dollars) at the end of the bear market.

Now, to the most important part of his story…

The Beginning Of Livermore’s Greater Fortune

There was a pandemonium in the market as at that time, investors had lost money and so much chaos in the market.

So, JP Morgan sought for Livermore to help him use his skill and influence to bring back the market to normal and Livermore was very glad to take up this task.

In doing this, Livermore bought lots of stocks at the market dips and most of his followers followed his footsteps and they all made massive profits at the end of that trend. But…

Just like as you know that we have ups and downs in the market, the same happened in Livermore’s life and below is how he handled it..

The Beginning Of Livermore’s Downfall

Livermore became so famous and rich that he could afford anything he wanted, making him to own alot of expensive stuff.

Afteral, here was a rich Billionaire who had money and he couldn’t control the urge of having a good life just like anyone would wanna enjoy life from his huge profits!

So, Livermore started losing more money when he began making wrong decisions against his own trading principles. And…

One of his major trading principles was never to listen to anyone but himself. Just like EmperorBTC would always say;

“never listen to the news, never listen to anyone else but focus on your charts and make your own decision”

-EmperorBTC

Livermore had lost upto 90% of his fortune due to wrong advice he got from another person and he eventually ended up in $1,000,000(1 Million Dollar) debt.

Is this the end of Livermore?

Not so fast! This is where it gets more interesting and you need to see what I’m about to show you next about his life…

Livermore Once Had a Fighting Spirit and He Exercised it Here!

Livermore was never a person who could chicken out easily and give in to failure during his prime. No!

So, he called for help and raised some shares which he used to start trading back once again. But..

Before Livermore could start trading back, he did something most traders of today wouldn’t do.

Can you guess what it could be?

I want you to pay more attention to this part, it’s very crucial…

Livermore began studying the market the more and waited for six (6) weeks of being PATIENT BEFORE HE MADE HIS MOVE.

And what’s the result of that?

Once again, Livermore was very accurate in his move and he made alot of profits that he went on news and TV as a man who came back from bankruptcy to make an unbelievable comeback and earned more millions of dollars!

That’s not all…

Do you know?

Livermore’s profits was nothing compared to when he changed his office and noticed a familiar pattern in the market which led to the crash of the market during his early life.

After he noticed this pattern, he decided to open a SHORT position and added more positions along the way and guess what?

He was accurate again and he made Billions of dollars and this made him one of the genius traders of all time. But…

Here’s my worries with this guy…

Let me ask you this…

If you’re to make Billions of dollars with all this money like he did, would you ever imagine ending up as Livermore the way he did?

Okay, wait, before you answer that question, see the next paragraph to find out the end of his shocking career…

How Personal Issues Can Affect Your Trading Business

Livermore ended in bankruptcy the third time due to lots of personal issues in his life.

Issues like getting divorced from his wife due to his inability to protect his capital in the market.

Livermore blew up his account due to his negative Trading Psychology and turned to his wife to lend him money from the jewellries he bought for her but she disagreed.

This resulted in their quarrel, filed divorce and he went on to get another wife.

History also had it that, at a point he became complacent about his situation and relied on his new wife’s money for everything.

One of the errors he committed was that he married his third wife whose name was Metz’s Nobel as her fifth husband in which atleast 2 of Metz’s previous husbands had committed suicide!

One of Metz’s husbands was Warren Noble that hanged himself after the wall Street crash of 1929.

All these issues happened to Livermore and he lost his drive for trading even though he was still believing he would make his come back like before which it never happened!

Here’s the final part of his story…

Tragic End Of The Legend Jesse Livermore – Result of Negative Trading Psychology

On one evening, Livermore shot himself with an Automatic Pistol in one of the hotel rooms of Sherry-Netherland in Manhattan, where he normally had cocktails. And..

Police found this suicide note of 8 small handwritten pages in Livermore’s personal, leather-bound notebook.

The note was written to his wife named Harriet whom he fondly called “Nina”.

Here it reads;

“My dear Nina: Can’t help it. Things have been bad with me. I am tired of fighting. Can’t carry on any longer. This is the only way out. I am unworthy of your love. I am a failure. I am truly sorry, but this is the only way out for me. Love Laurie”.

-Jesse Livermore

One more unpleasant news…

His son Jesse Livermore Jnr. committed suicide and his grandson also reported to have committed suicide both killing themselves with their own hands.

Before you tell me the lessons you picked from this story, I have prepared a short and concise summary of the lessons for you from this article and from this story which I wouldn’t want you to forget in your trading journey.

Here they are…

Lessons Derived From This Article and The Legend Jesse Livermore’s Story

- You have learned how to brake an abstract or hard to understand concept/topic down into seperate terms and thereby combining them together to give a better understanding. If you didn’t pay attention to it, try and go back to the beginning of this article now and see how it’s done(on Trading Psychology) once again!

- The early life of Jesse Livermore gave us a hint to pay attention to a child and understand their innate skills. He had skills with numbers and reading financial newspapers was the turning point for him as this helped build up his maths and finance skills. This can help us shape the career of our kids once you notice their innate potentials, you can help build them out.

- Livermore knew what he was good at which was numbers and he decided to take up a job at a bucket shop where he spent more time with numbers and how they moved. This shows that you can deliberately shape your destiny by some decisions you take and some jobs you do. And once you know your areas of talent and strengths, you can connect all other things to building it out and achieving your goal/vision in life.

- When Livermore was banned from his own town, he didn’t give up on trading and didn’t give it up for something else or take another job! He had to change his environment. He believed in himself and his skills and thereby found another domain he could explore and become successful, so he moved to New York and achieved his aim. This means you must be flexible and being able to explore and test your skills else where. You must be able to survive anywhere you find yourself.

- Livermore started trading back in New York and because he didn’t stick to his own trading systems. His money started reducing. One thing you should never do is to give up any system that’s working for you. In as much as it’s still making you more profits than losses, you should stick to it, paper trade other systems you discover and not with your real money. You should be only using your real money once it has been tested and back tested with paper trading and it has been consistently making you profits than losses.

- Livermore took the advice of a friend and invested in cotton which made him lose money as his friend was SHORTING the market while he was LONGING it! This was against his own rule but yet he worked against it. This means you should focus only on your trading rules and never listen to anyone, news, FUD or any influencer. FOCUS SOLELY ON YOUR CHARTS and LISTEN TO IT.

- I still find it difficult to imagine Livermore made Billions of dollars and he blew it up to the extent that he ended up in debt. Remember that he engaged in extravagant life too? It’s not bad to enjoy life but it has to be moderate so you don’t blow up your capitals and profits and end up in debts like he did. Always protect your capital and invest some of your profits also in real assets like real estate and other physical assets. Don’t put in all your profits in the market as the market might take everything out from you as he did to Livermore.

- Livermore was never someone that chicken out easily, he had made his come backs different times and the last time he couldn’t why? Because of his life issues connected to his marital life. Before you marry if you’re still lucky to be single by now, chose the lady wisely. Study her and pay attention to her background history. Don’t let love cloud your reasoning faculty. Imagine atleast 2 of Metz husbands committed suicide and Livermore still went ahead and marry this woman as her fifth husband. So, he also ended up commiting suicide as others.

- Another thing is that, history repeats itself probably due to ignorance or not paying attention to your spiritual life. Livermore committed suicide, his son Livermore Jnr committed suicide and the grandson also committed suicide. I don’t want to believe his son and grandson believed that suicide was a normal thing for anyone to do before they took their lives like their father. This means whatever you do or any decision you want to make in life, know that someone is watching you. Therefore, leave a good reputation behind, a good legacy that others would follow and not the bad one.

- Lastly, I would advice you to take your spiritual life also serious irregardless of your religion either Christianity, Islam, Judaism, Budahism or what a view. Why? Because, religion does something to you; it renews your mind, your soul and makes your mind think properly knowing good from evils and being able to caution you in doing the right things over the wrong ones. I am sure that, if Livermore was more spiritual, he would not have made all that money and still ended his life the way he did because, he would have learned to balance his life through the renewal of mind and soul religion would have done to him. Please, take your spiritual life serious!

Recommended Post: How To Make Money On Bitcoin Trading – Detailed Beginners Guide

Conclusion – All in One View About Trading Psychology!

I have been able to explain the abstract topic of Trading Psychology by braking it down into single entities and coupling it together to give you a better understanding in a layman’s view.

Also, I have been able to take you on a journey into the life of the legend Trader called Jesse Livermore by showing you his pros and cons, the mistakes he made, the good part of his life and the ugly side.

And finally, I was able to demistify the important lessons that would guide you on your trading journey by avoiding the Livermore’s pitfalls and having the potentials to becoming a successful Trader in your lifetime.

Your Trading Psychology can be positive or negative depending on how you handle your emotions.

Greed, fear and hope are major emotions common among the traders in the market and you should learn to reduce wishful thinking and embrace the facts to ensure you have the right Trading Psychology.

“Wishful thinking must be banished”

-Jesse Livermore

If you lose your capital again after reading this article due to your emotions, then you have alot of work to do on your Trading Psychology!

What’s Your Biggest Take Away? Tell Me a Lesson I didn’t Mention

I hope you have enjoyed this article and if you do, kindly leave me in the comment section your key takeaway in this story or..

Let me know the lesson you deduced personally from the article which I have not been able to mention.

And if you have enjoyed this article, feel free to share it to your friends and loved ones by using the social media buttons at the end of this post.

If this story has motivated you to discover more about trading and how you can start trading Cryptocurrency, you can check this article out here.

Or if you have been reading about Crypto Trading and now you feel you have all it takes to start, then register here, it’s the biggest exchange in the world and that’s what I use most times for many reasons, so, I recommend it.

Here are other exchanges I also use which I can recommend to you: BINANCE, GATE, MXC, HOTBIT, OKEX, LATOKEN.

Incase you want ideas on other businesses aside trading, what I share in this article would help you find the answers you need. You can read the article here.

If you would like to be part of this community, you can join our Telegram community now.

If you also have any question or enquiry or anything at all, feel free to use the comment section and leave me your message, I will reply you as soon as possible.

Thank you for reading.

Wish you all the best!

If we ain’t talking profits, then we ain’t talking!

All rights reserved. This material and any other digital content on this website should NOT be reproduced, published, broadcast, written or distributed in full or in part, without written permission from PROFITSTALKING owner.

Learnt a lot. Self descision is good and reliable. Thanks boss

Hi Temitope,

You’re welcome.

Yes, it’s good to have self-discipline and being able to stick with your own trading rules especially the ones that work for you and bring you consistent profits.

Thanks for stopping by.

Hi, Mike

Thank you for sharing this informative and inspiring post.

I have learned from Jesse Livermore’s Story that listening to other made him lost his trading capital.

And also he took a whole 6 weeks to analyse the market and that led him to make good profits.

Now my question: can someone be successful by watching and analysing the market without taking part in any trading course?

Thank you again.

Looking forward your next article.

Sebastian

Hi Sebastian,

You’re welcome. Glad you found the content informative and inspiring.

To your question, we have different types of traders, I explained it in one of my posts.

Infact, if you are not interested in trading and you still want to make money on Cryptocurrency, you can just be an investor.

Being an investor means you’re buying coins and investing in projects you believe will do well on long term and you’re not bothered about the short term profits.

You can invest for 3-6 months or even years before you take profits or sell your bags.

This doesn’t require you to do much trading analysis like being a scalper, day trader or swing trader. But..

I still believe that to avoid investing in wrong projects, you still need knowledge but having FUNDAMENTAL ANALYSIS knowledge will pay off more for you here than TECHNICAL ANALYSIS (T.A) as an investor.

Though, to make more profits, having both knowledge is advisable and I highly recommend you learn both if you have the time and patience.

You can decide to learn on your own with the available resources online using Google or YouTube videos and you can decide to pay for a course on it.

The most important thing to be successful either as a Trader or Investor is knowledge and action.

Having the knowledge to make research to identify good projects from the wrong ones to save you from projects that run away with investors money(called rugpull) and more.

So, what matters most here is knowledge just like in any other business and being able to take action to invest when you plan to do that.

I hope I have been able to answer your question and if you still have any question left, please, feel free to ask me.

Here’s the link to the article on types of traders we have and more.

I will explain more on fundamental and Technical Analysis in my future posts.

Ensure you subscribe to our mailing list so you can be notified when we have new post on the site.

And don’t forget to share this content using the social buttons at the end of the post if you’ve found it useful.

Thanks for stopping by Sebastian.

A very good citation on the topic of discussion. Very encouraging and insightful too.

Hi Yusuf,

Thanks for letting me know you found the content encouraging and insightful.

You can check around the website for more useful content.

Feels exciting when you can find most affairs/content in a website…hope to see more to learn from.

Hi Chinasa,

Thanks for letting me know how you feel about our website.

Yes of course, you can be sure there would be more new content to learn from in later days.

Don’t forget to subscribe to our mailing list if you haven’t to be notified for new posts when available.

You can also share any content you find useful using the social share buttons at the end of the post.

Thanks once again for stopping by.

There are lots of lessons in the article but I think the most important for me is his determination.

He had lots of set backs even to the extent of being expelled from his town due to his brilliance but he didnt give up.

In summary, I just took the lessons of putting proper efforts in achieving something and persisting on your goal no matter the set backs until the goal is reached.

Just like I said lots but, let me just leave it here.

Hi Paulesma,

Wow, you have really taken so much time to write me detailed lessons from the post.

And yes, you’re very correct, Livermore determination and persistency during his prime was second to none.

Glad you have learned alot from the story and thanks for leaving me a detailed feedback.

Don’t forget to share the content to others using the social share button so they can benefit from it.

Thanks for stopping by.

Wow…. This is an eye opener..

So many lessons learnt.

Determination and wrong decision is key for me.

Thanks mike

Hi Priscilla,

Glad the content opened your eyes to many lessons!

Don’t forget to avoid the mistakes you’ve learned here during your trading journey.

You’re welcome, you can check around the website for more useful content.

The story teaches a lot of lesson

It is better to learn from another person’s mistake than to fall into the trap

Thanks to profitstalking kudos to you boss👍

Hi Victoria,

It’s true that, it’s important to learn from others’ mistakes to avoid falling into the same traps.

You’re welcome. Thanks for stopping by.

Thank you Mr Mike,

This is so inspiring. A loaded story. Jesse’s life is indeed full of lessons for every trader.

I learnt never to try out new strategy with your money, but with paper till the strategy is proven to be a winning one. Also to stick to my winning strategy as much as possible and more importantly limit external influence on your trading decisions.

Finally, law “history repeats itself” is not limited in application in trading but also in all areas of human life. Our behaviors don’t change.

My time reading here on this platform has never been a waste. Another great content. I recommend that you talk about what new traders need to do grow their trading skills.

Thank for the education and the information you dish out here.

Hi John,

It pleases me to see how much you learned from this article and try as much as possible to practice what you’ve learned.

ACTION is what separate the achievers from the non-achievers. And..

Based on your request, I will try as much as possible to write a content on it in the later days probably in the week of the new year 2022 by God’s grace. But..

Till then, every beginner trader or investors need to increase their KNOWLEDGE and follow those who have been in this business and know what they are doing to increase their skills.

There is nothing that can be compared to knowledge and experience of other senior traders.

Read blog articles like this one, read books on trading and take courses to improve your skills.

I recommend you take this trading course to develop and improve your trading skills.

If you have any more questions, you can let me know. Thanks for stopping by John.

Agreed, it’s a useful message.

Quite good topic.

Thank you so much Mike

I really learnt a lot from the psychology of trading

*DO NOT LET YOUR EMOTIONS INFLUENCE YOU WHEN TRADING*

Hi Noble,

You are welcome.

I am happy you learnt a lot from this content.

Yes, don’t let your emotions ride you when trading.

Thanks for leaving me your feedback.

Keep checking back for more new content.