This article simplifies most important terminologies about Futures Contract, how to trade it and also reveals why you should trade Futures Contract on Binance as a Crypto Holder.

It is much easier to put existing resources to better use, than to develop resources where they do not exist.

― George Soros

While you can buy Cryptos and wait for a long time to make profits on Spot market alone..

You can buy cryptos (go LONG) and also sell Cryptos (go SHORT) and make profits on Futures Contract on Binance.

This is one of the advantages why a Crypto holder like you should consider trading Futures Contract.

This and more you will find out in details as you proceed in this beginner’s guide to Futures Contract Trading on Binance.

- What are Futures Contracts?

- What is Perpetual Futures Contract?

- 10 Reasons You Should Trade Futures on Binance as a Crypto Holder

- 7 Important Futures Contract Trading Terms to Know

- How to Trade Futures Contract on Binance

Before we dive in to the important reasons of WHY and HOW to trade Futures Contract on Binance..

Let me explain to you in details the important terminologies you need to know about Futures Contract as the topic under discussion.

What are Futures Contracts?

Futures Contracts can simply be called future AGREEMENTS.

That is, agreements that bind you as a trader to buy or sell an assets/cryptos in the future at a specific date and time.

Or let me define it as an agreement to buy or sell a commodity, currency or another financial instrument at a predetermined price and a specified time in the future.

This agreement known as Futures Contract specifies the number of units of an asset that will be bought or sold with price and the time at which the asset will be settled.

As a case study: imagine you are in a city and you have an idea to start a food business maybe rice, cornflakes or oatmeal, and…

Of course you will need grain of rice or corn for the production, so you research a local farm online and found one that you can buy one or more ton of grain from, to start the business.

Before the grain get to you, there are few things that have to be in place;

First is the quantity (or units) of the grain you want to buy..

Second is the price at which the grain will be bought and..

Third is the date/time it will be delivered to you at a later date (in the future) for this grain order to be settled.

Even though, the farmers need a storehouse to store your grain before it can be transported to you in the city and sometimes the more the grain stay in their storehouse or…

the longer it takes for it to get to your location, the more the fees you are going to pay before your order agreement is settled.

The example above is an example of a traditional Futures Contract/agreement between the two parties involved. Hope you are getting the idea?

Three (3) things are very important in this definition and example cited above that I want you to understand, and I want you to take note of the third point below:

- Units or quantity of the asset you are buying or selling

- Price at which you are buying or selling

- Time and date for its SETTLEMENT

Also, take note that the settlement of this contract/agreement occurs at a specific expiration date.

Binance also has a Futures Contract that is similar to the traditional Futures example explained above and it is called Quarterly Futures Contract but…

The difference is that Binance uses the cash-settlement method instead of the physical product (like grain) as in the traditional Futures explained.

Binance settles the Quarterly Futures traders with coins like Bitcoin (BTC) or any underlying asset like Ethereum (ETH) and others.

It is also important to know that traders use both Technical Analysis (T.A) and Fundamental Analysis (F.A) to predict and analyze the price action of Futures Contract markets like any other investments or trading instrument.

Now, let’s talk about Binance Perpetual Futures Contract.

What is Perpetual Futures Contract?

A Perpetual Contract/agreement is a special type of Futures Contract that is different from the traditional form of Futures because…

A Perpetual Futures Contract doesn’t have an expiry date. This means you can hold a position for as long as you like.

A Perpetual Futures Contract is a contract or an agreement that doesn’t have an expiry date. You can hold its position as long as you like.

― PROFITSTALKING.COM

Binance offers most suitable Perpetual Futures Contract in which these contracts are traded at a price that is equal or equivalent to Spot Markets.

Since I trade on Binance Futures but most of my students are beginners and they trade on Spot Market…

What I do anytime I want to send Trading Signal to my followers on the Crypto Trading Hub on Whatsapp is that…

I get the Futures Contract prices for Entry, Take Profits and Stop Loss prices and then round it off to three (3) or four (4) decimal places to get the accurate Spot Market prices for them and…

The prices are always the same or equivalent with the Spot market.

Now that you have understood what Futures Contract are and the Binance Perpetual Futures..

Let’s talk about why you should Trade Futures Contracts on Binance as a Crypto Holder next before we go into how you can trade it.

10 Reasons You Should Trade Futures on Binance as a Crypto Holder

Below are the 10 reasons why Binance is considered the best platform for you to trade Futures Contract as a Crypto Holder.

Short Selling Opportunity:

in Spot market, you can only buy and wait for the market to move higher above your price entry to make profit. But..

With Futures Contract on Binance, you can make profits by shorting an asset (also means selling it.)

This means you can profit when the market goes up or comes down.

You don’t have to wait for the market to go up alone to make profit.

You can now buy (LONG) or sell (SHORT) any Crypto while trading Futures Contracts on Binance.

Leverage/Money Multiplier:

Leverage means money/position multiplier that multiplies your profits/losses and Binance offers up to 125x leverage to increase your trading size allocation for more profits.

This means you can grow your portfolio no matter how much you have to commit to trading.

Note: newbies to Futures Contract Trading are advised not to use more than 2x as leverage just to test it out and see how it works with your discovered trading strategies unless..

You know much about Futures Contract trading and you are sure of what you are doing because…

Futures Contract come with HIGH RISKS and also with HIGH REWARDS!

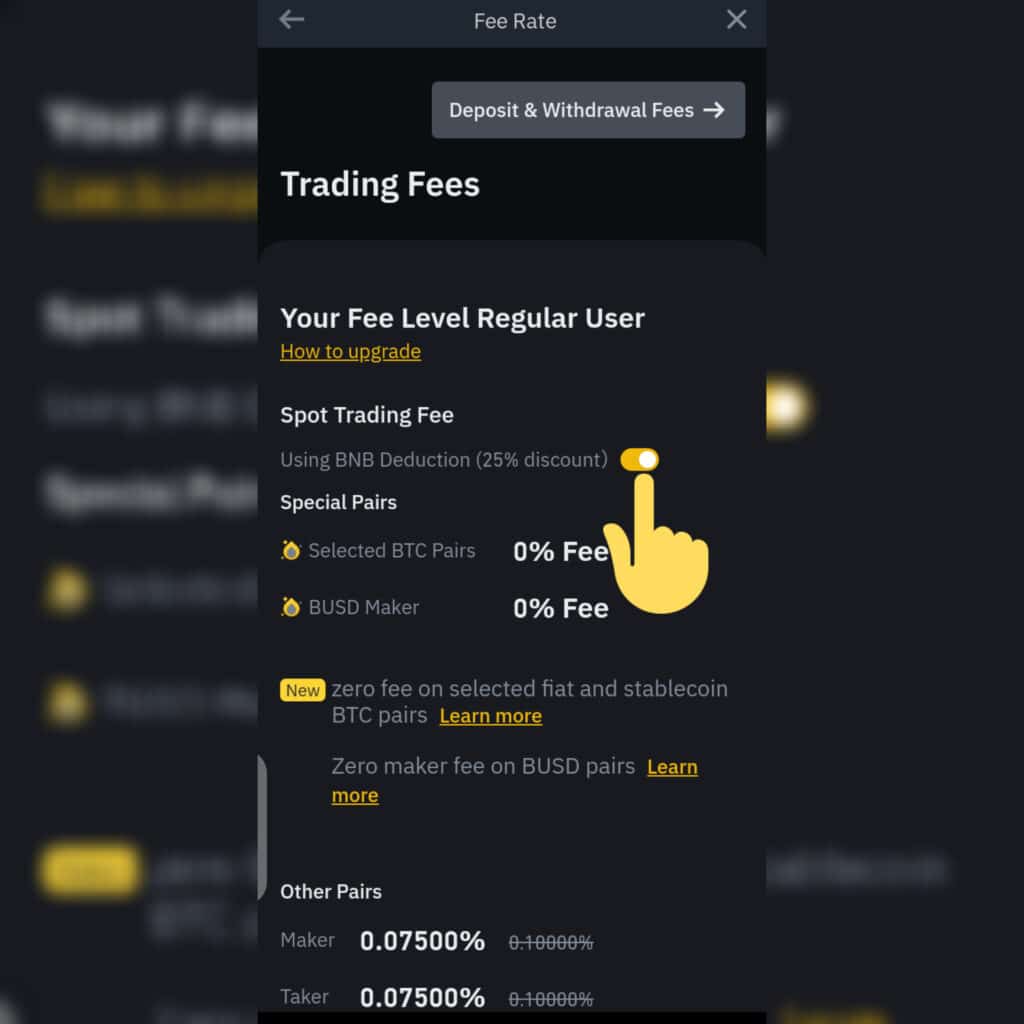

Low Trading Fees:

Binance Futures Trading offers you a very low Maker/Taker fees with as low as 0.017%.

This gives you an opportunity to make more profits as you pay less on trading fees.

BONUS: you can even pay lesser fees for holding BNB in your portfolio which is a Binance Crypto asset.

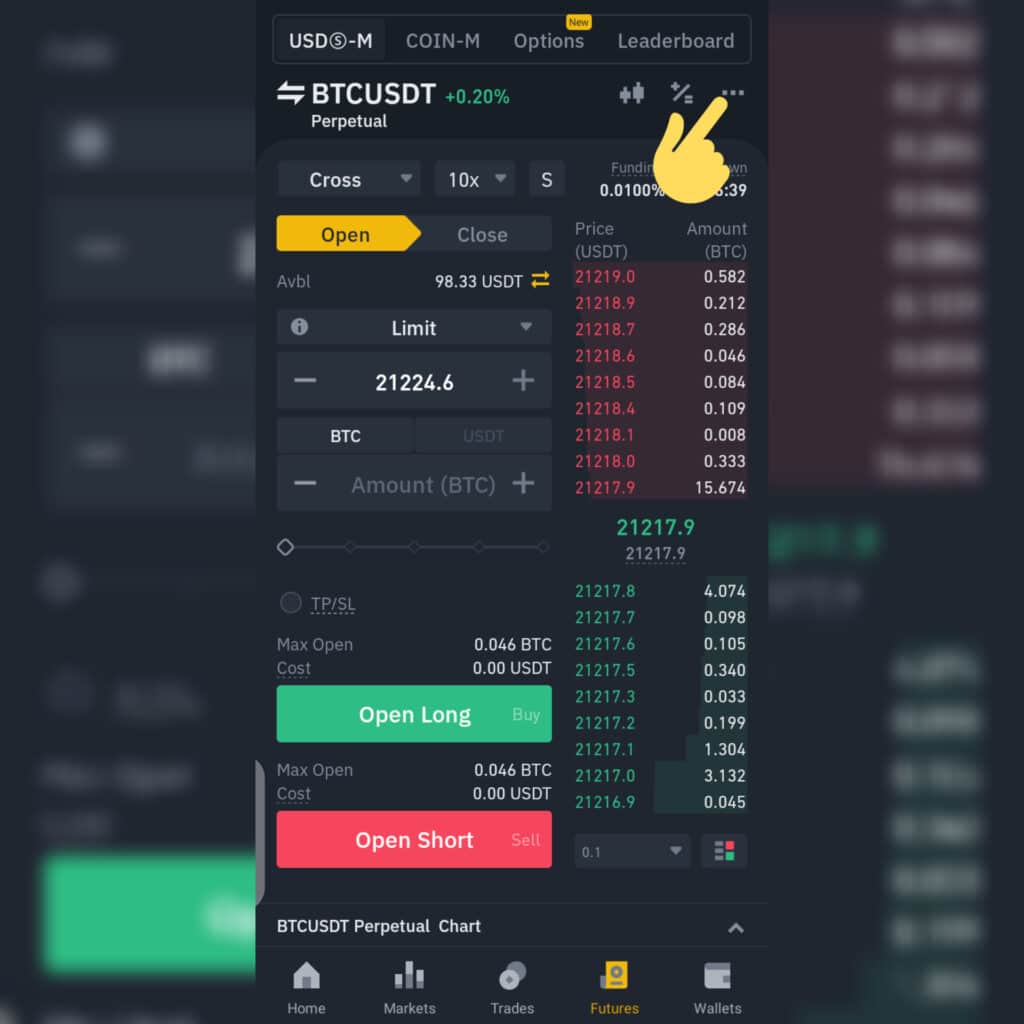

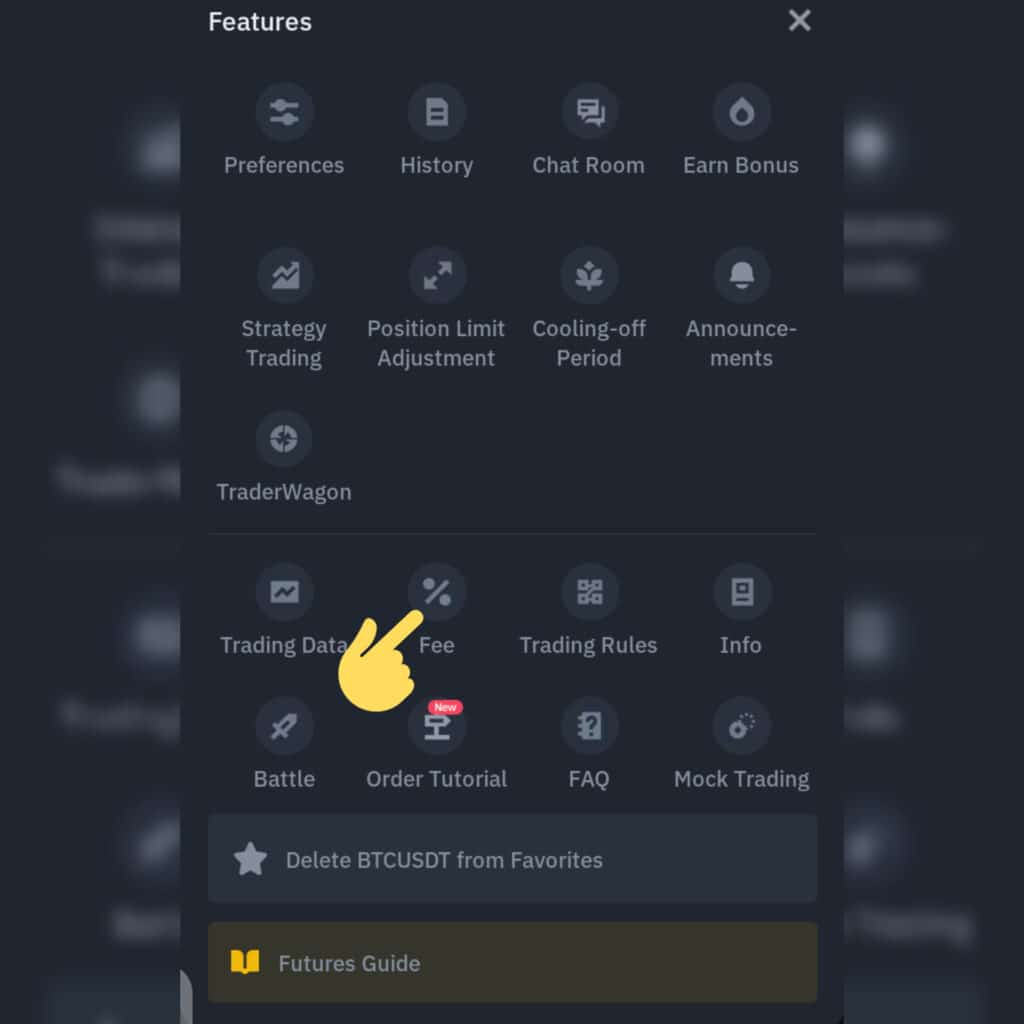

To use BNB to pay low trading fees, you need to activate it by following the instructions in the screenshot below:

You can even get up to 25% DISCOUNT on your trading fees when you use my Affiliate link to register on Binance as a new user.

You also get $100 welcome BONUS plus 10% LIFETIME CASHBACK on your trading fees as well.

Note: you can also deactivate the button anytime you don’t feel like using BNB to pay your fees anymore.

More Than 500 Trading Pairs:

with over 500 trading pairs on Binance Futures Contract, you can trade anything from Metaverse like SAND, DeFi like CAKE to Memecoins like SHIBA Inu and Dogecoin.

That’s not all, because, new coins are being listed regularly to give you the best trading experience and more.

Over $300 Million Insurance Fund:

Binance have you in mind as they ensure that you are protected all year round with their multiple security features in place including the over $300 million insurance fund against issues like hacks or any technical errors that might make you lose money or accrue losses.

Over 28 Million Active Users:

With Binance being number one and biggest exchange in the world, every Crypto trader is of the opinion that..

If any project is listed on Binance, then it is considered legitimate and SAFU(Funds Are Safe) to trade or invest in.

This is the responsibility and the reputation that Binance has built over the years and has made more people flock to Binance and..

The number of users keep increasing plus the initial over 28.6 million active users.

Largest Trading Volume:

In 2021, Binance experienced $7.7 Trillion in Crypto exchange volume and a 24-hour peak of $76 Billion.

This shows that Binance is home for Crypto traders, users and adopters around the world.

Highest Liquidity:

Binance Futures Contract is one of the most liquid derivatives exchanges in the world market.

You as a trader can expect your buy and sell orders to get filled as at when expected without you getting worried about slippage because of the high liquidity on Futures exchange.

Enterprise Grade Security:

Binance is the number one in the world and one of the most secured trading environments and..

This is achieved also with their top rated security features like Know Your Customer (KYC) and Two-Factor Authentication (2FA) to protect you against hackers and an unauthorized access into your account.

Multilingual Support:

Binance provides you active and responsive support in 17 different languages with simple and easy-to-use interface that makes trading easy for you and anyone to participate no matter which part of the world you are as a Crypto user and adopter.

Feel free to trade Futures Contract on Binance, your funds are SAFU from hacks and technical errors.

― PROFITSTALKING.COM

7 Important Futures Contract Trading Terms to Know

Before we go into how to trade Futures Contract on Binance..

There are seven (7) important terminologies I need to introduce to you now so it all makes sense to you when we get to the next stage on trading Futures.

Let’s see them below;

Margin

Margin: margin simply means the value or amount that is required to enter a leveraged position (that is, the money needed to trade on Futures Contract in simple terms.)

Cross Margin

Cross Margin: this is a margin whereby your available balance is used to manage all your open positions.

The available balance is useful here because ..

incase one or few of your positions are having unrealized losses..

Then the unrealized profits from the other positions can help neutralize the losses with the available balance.

Binance Futures Contract has Cross Margin as the default as it can help traders against unnecessary losses.

Isolated Margin

Isolated Margin: this is a margin where each position has a separate margin given to it.

Unlike in cross margin where only one margin is shared across to all open positions.

This means that..

In Isolated margin, even if there is a loss on this separate position, only this position is affected.

NOT the entire balance and other unrealized profits cannot be used to neutralize the losses here.

Initial Margin

Initial Margin: this is the minimum value or amount you commit when you open a leveraged position.

For example, if you buy $1000 of any asset with the initial margin of $100 at 10x leverage.

This means you have opened a $1000 position with initial margin of 10% of the total order of $1000.

Maintenance Margin

Maintenance Margin: this is the minimum amount of collateral you must hold to keep your trading positions open.

Binance gives you a margin call that is; asking you to add more funds to your account when your margin balance drops below your maintenance margin level and..

If you fail to add more funds, your account could get liquidated and your position might be closed with the loss.

Liquidation

Liquidation: liquidation simply means when your futures account balance gets blown off!

Your Futures account is subject to liquidation if the value of your collateral is lower than the maintenance margin.

This means that, if your total position is large, you also need to keep it open against liquidation with a high maintenance margin.

You can avoid liquidation by closing your position early enough manually or..

You can add more funds to make the liquidation price move away from the current market price.

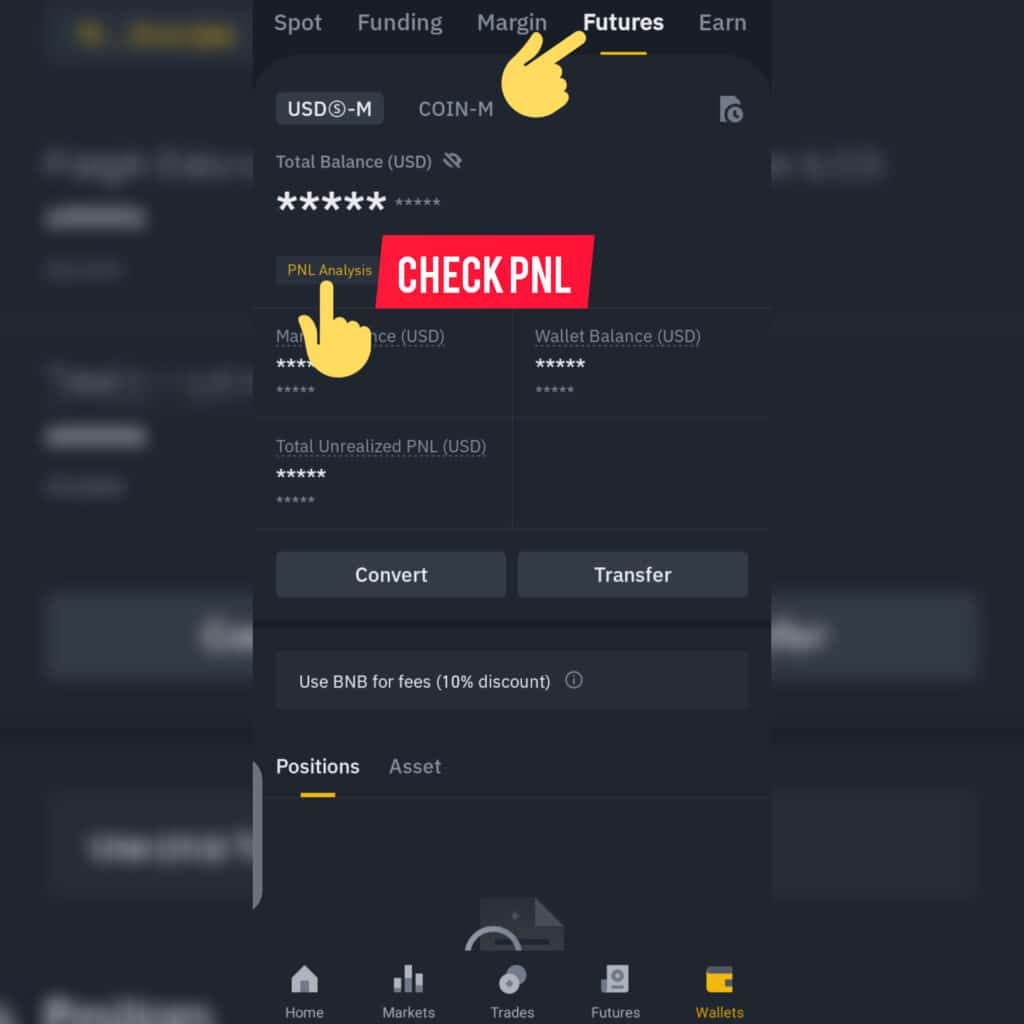

PNL

PNL: this means Profit and Loss (PNL). Your PNL can be realized or unrealized profit/loss.

It is a realized profit or loss when your position has been closed while..

Your profit/loss can still go sideways either up or down to favor you or against you in as much the position is still open.

Cross margin allows all your open positions to use the same available balance while Isolated margin uses a separate margin allocated to a particular position.

― PROFITSTALKING.COM

How to Trade Futures Contract on Binance

Now, let’s get into it. I will be showing you how you can trade Futures Contract on Binance that is; how you can go LONG or SHORT, set Profit and Stop loss targets at the same time and more…

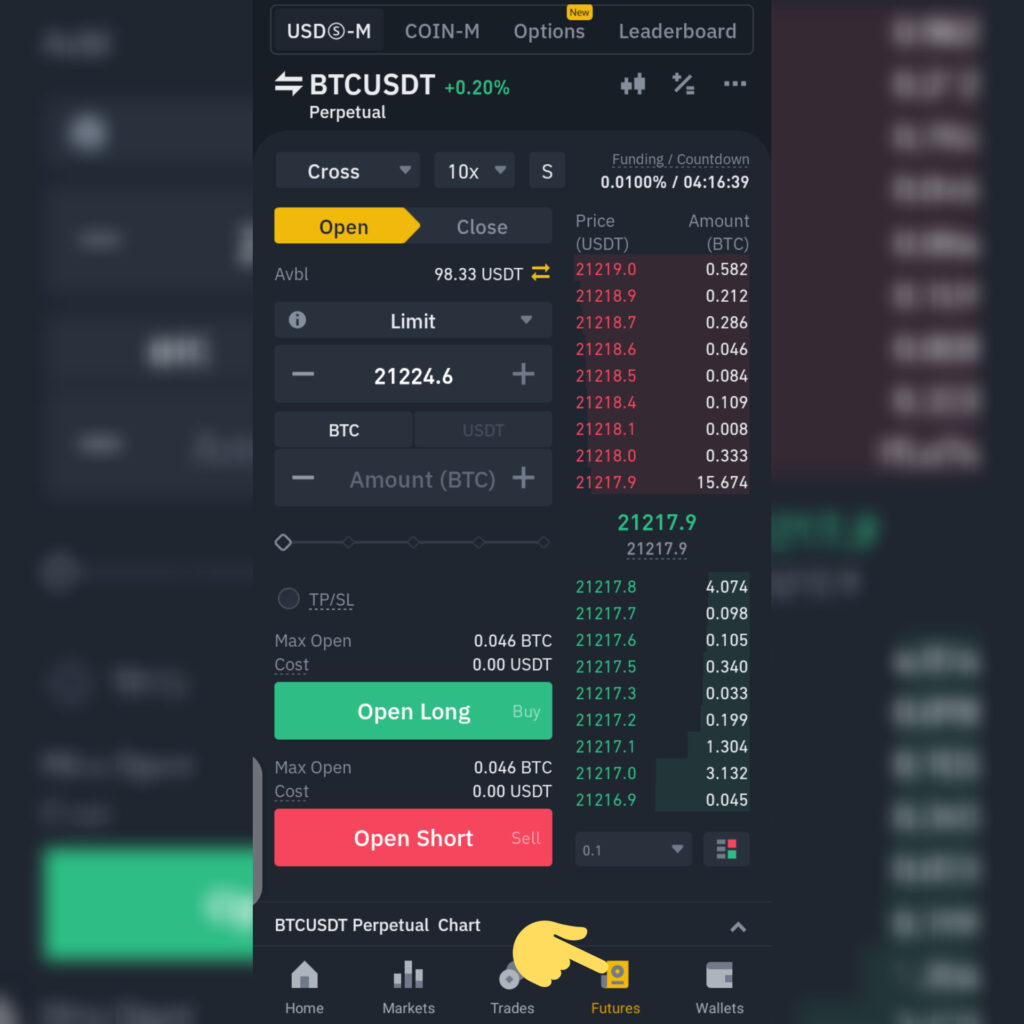

How to Fund Your Futures Contract Account

Before you can open a short or long order, you need to first fund your account, so follow the instructions below in the screenshots as a guide;

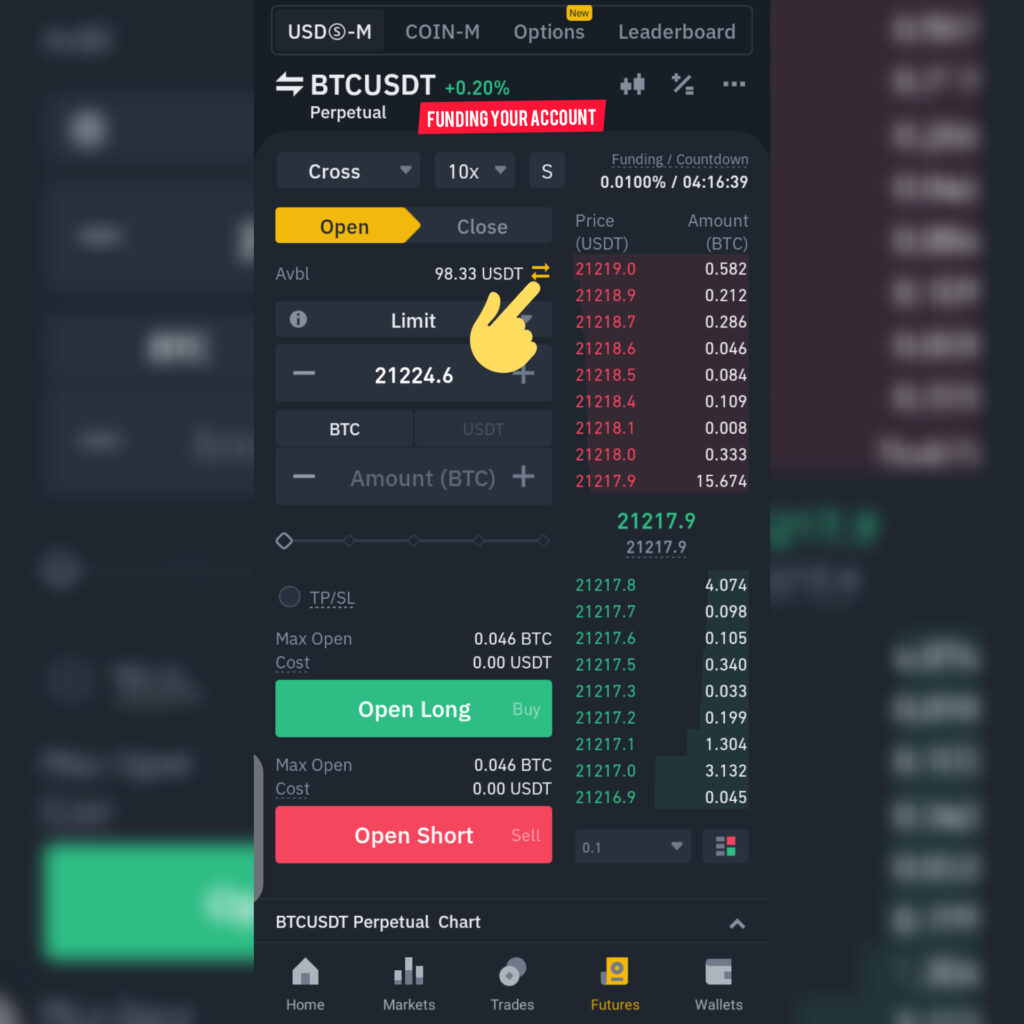

From the Binance App homepage, click on FUTURES as it’s in the first screenshot below then, click on the forward and backward arrows on top of each other in the second screenshot to take you to the funding page:

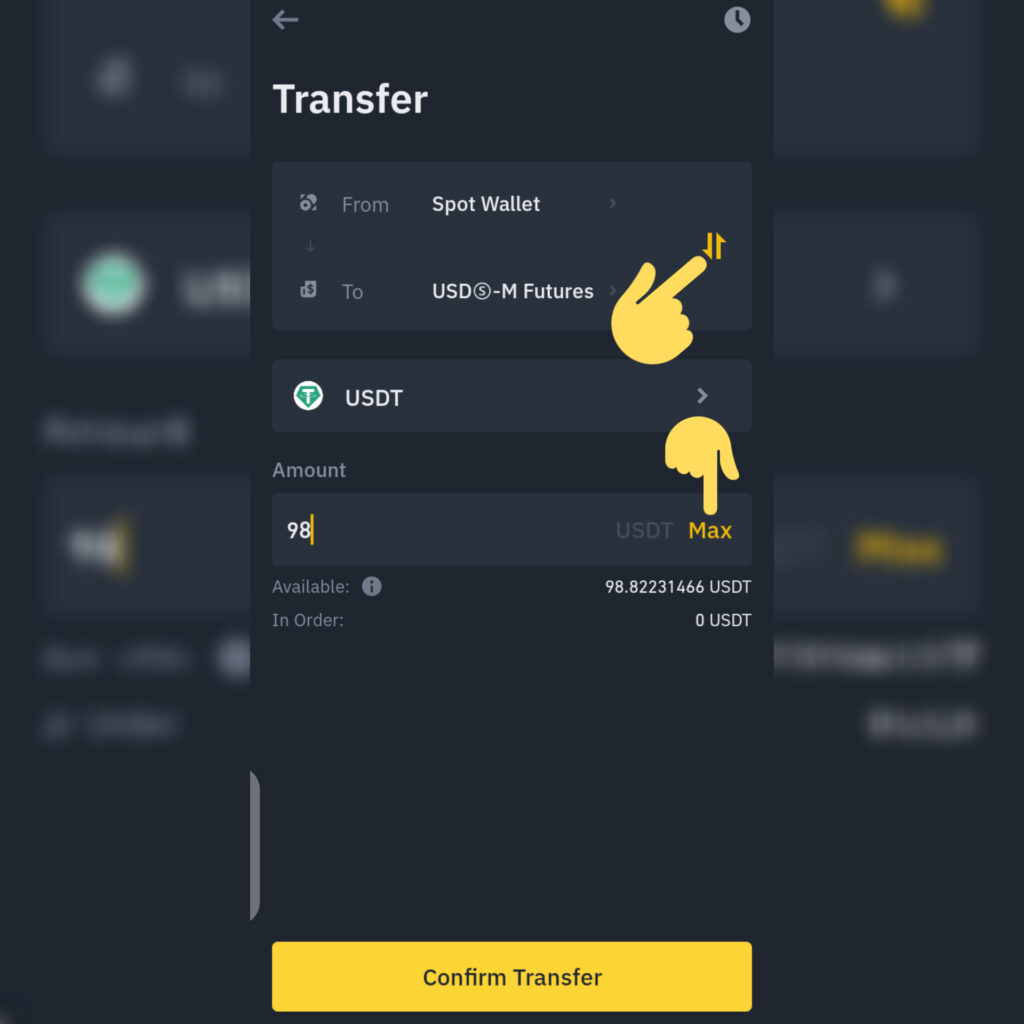

Now, on the next screenshot below is where you need to fund your Futures account by transferring money(USDT) from Spot to your Futures account while trading the USDT Margin.

You can use this same method to fund your COIN Margin account if you want to trade with $BTC or ETH but it might be complicated for a beginner.

I recommend you start with USDT Margin. Continue reading below….

The account you are transferring from must be at the top so you can see your USDT balance and..

If USDT is not selected, click on it and change the coin from $BTC to $USDT as shown in the screenshot below:

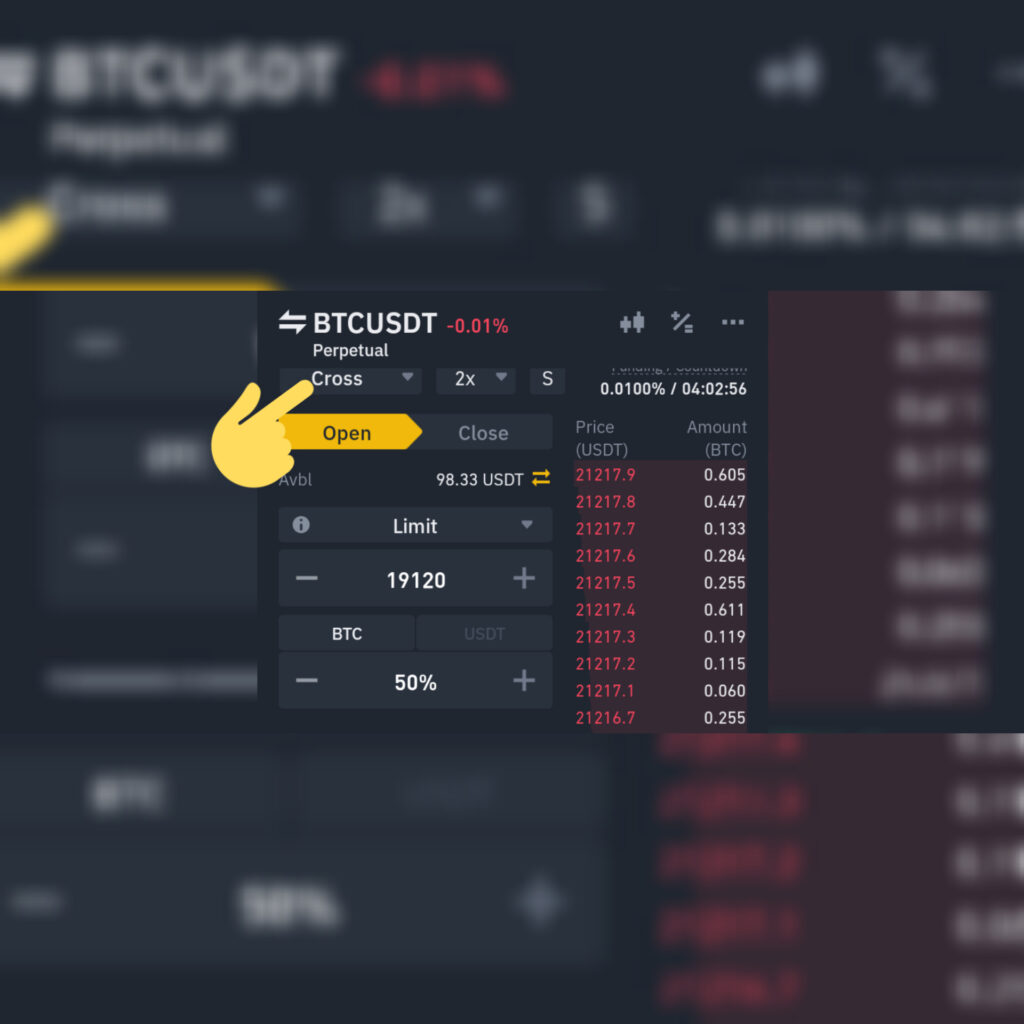

How To Set Your Futures Contract Margin

By default, Binance has a Cross Margin activated for you to protect your margin balance but..

Let’s see how to set it in the screenshot below..

Just click on the word Cross and you can change it to Isolated Margin but not recommended unless you know what you are doing;

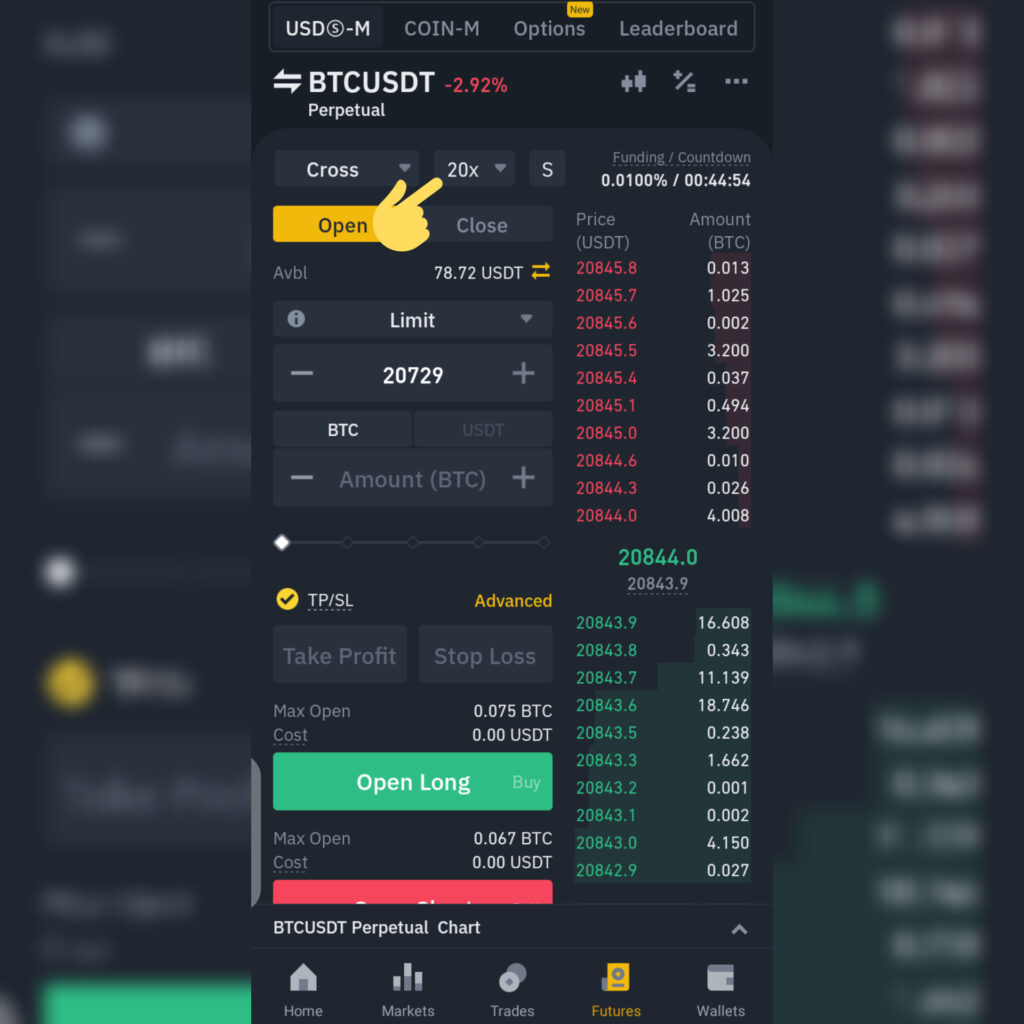

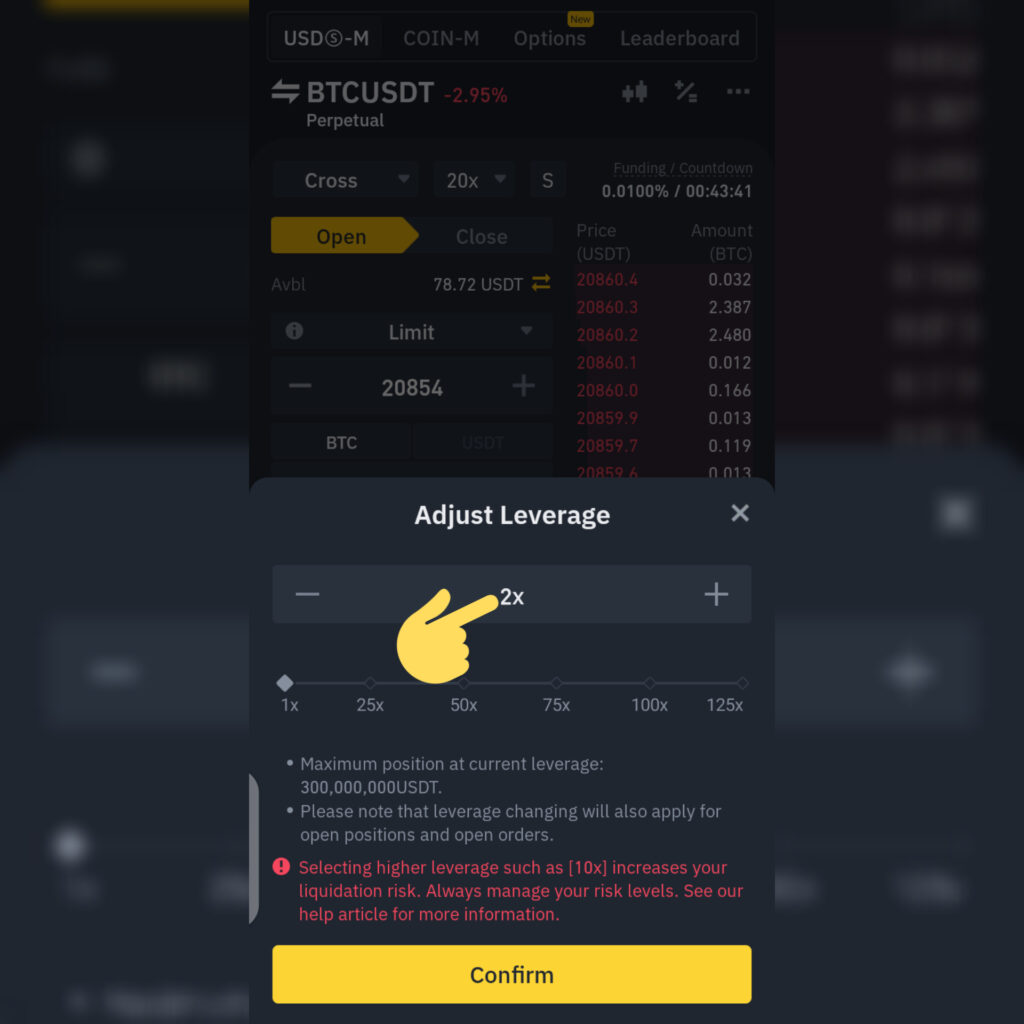

How to Set Your Leverage to Begin Trading Futures

Now, let us move to the next part which determines whether you are going to the village or to the city which is called profit/loss multiplier! – Leverage.

Before you open a position, you need to set your leverage. So be careful of the leverage you use.

To set your leverage, Click on the 2x or 10x depending on what you can see and change it to 2x just to try it out and see how it works.

That means you have the opportunity to double your profits/losses.

When you are confident enough trading Futures with good results, you can increase it to 5x or 10x. But..

For now, stick with 2x to start trading to minimize your risk.

After you have clicked on the 10x, or 20x, you can drag the leverage bar down to 2x to set it as it can be seen in the screenshot below;

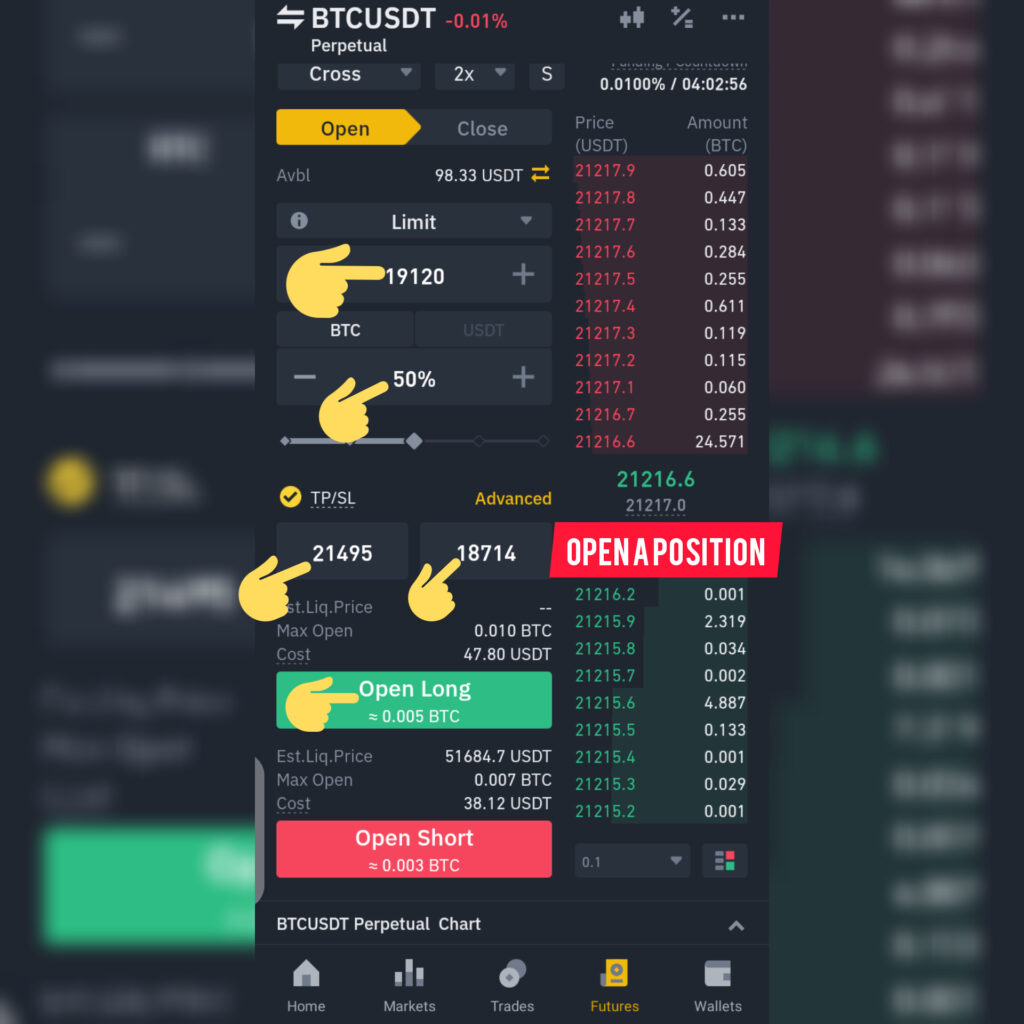

How to Open a Long or Short Position With TP/SL Orders

You can open a long or short position while you set your Take Profits (TP) and Stop Loss (SL) orders at the same.

Follow the screenshots below to see how it’s done;

In the screenshot above, opening a LONG or SHORT position using the LIMIT or MARKET ORDER is similar to Spot Market orders as you can see but..

Here you can also set your Take Profit and Stop Loss Order at the same time coupled with any leverage you want to use.

So, to open a position you must have analyzed the market to have come up with all the prices points to enter the market…

like the Entry price, Take Profits and Stop Loss prices or probably you have those prices given to you as Trading signals from someone you believe in and follow.

Once you have entered all prices for the LONG Order as in the example above..

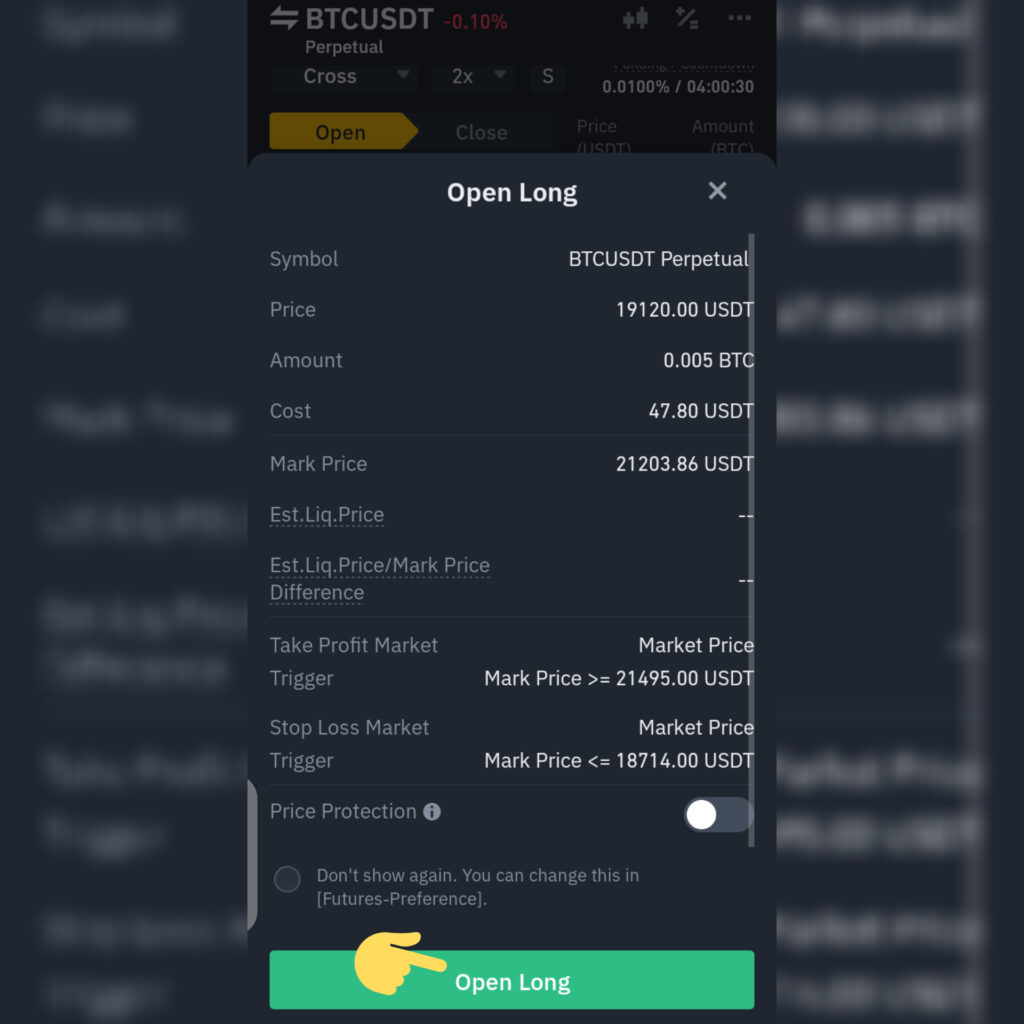

Then click the OPEN LONG button to create the long order and this will take you to the next page below;

The screenshot above shows you the market prices of all your entries and asking you to review it as a confirmation, and..

After all is good as you plan, then you can go ahead and open the position.

The same way you opened the LONG position is also how to open a SHORT position.

You only have to click on the OPEN SHORT button instead of LONG after you have entered all entries for the SHORT order.

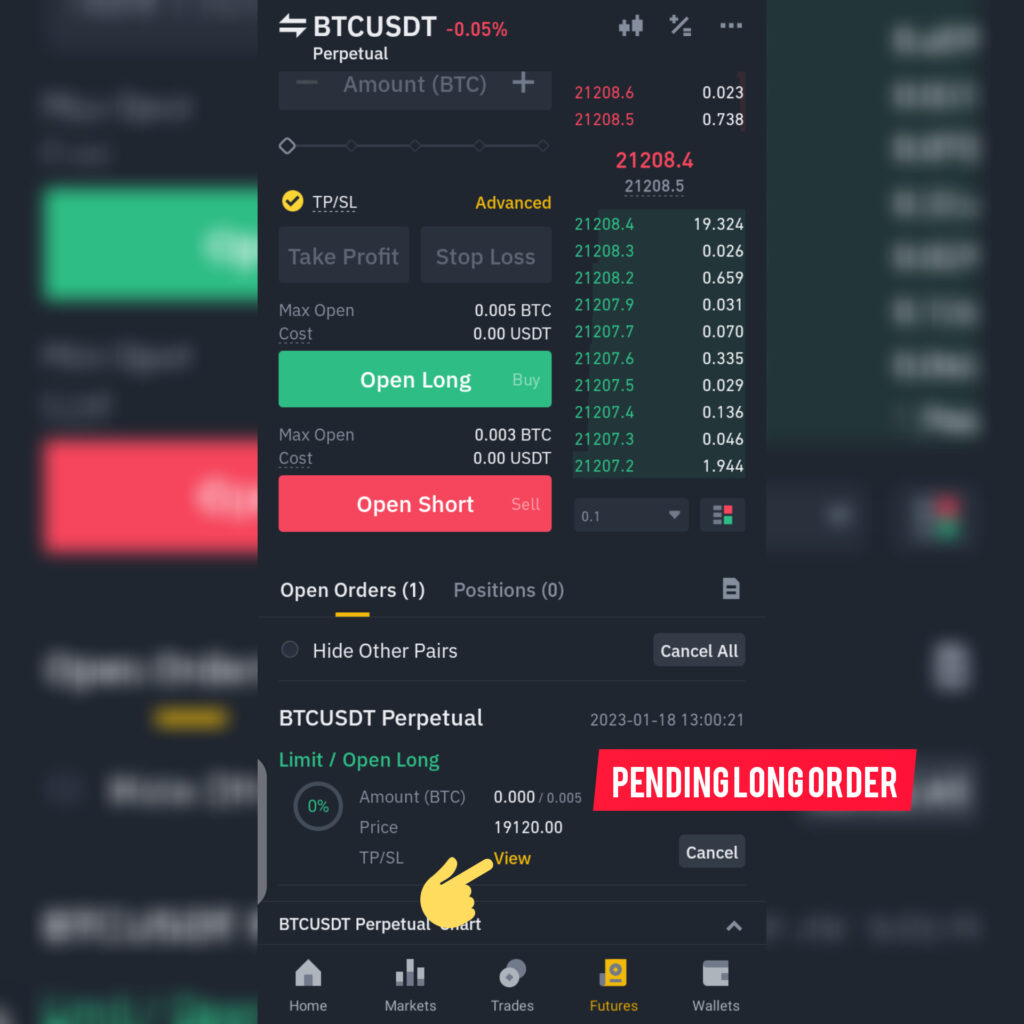

So, after you have Opened the LONG order in the last screenshot, below is the next page to see your pending LONG Order;

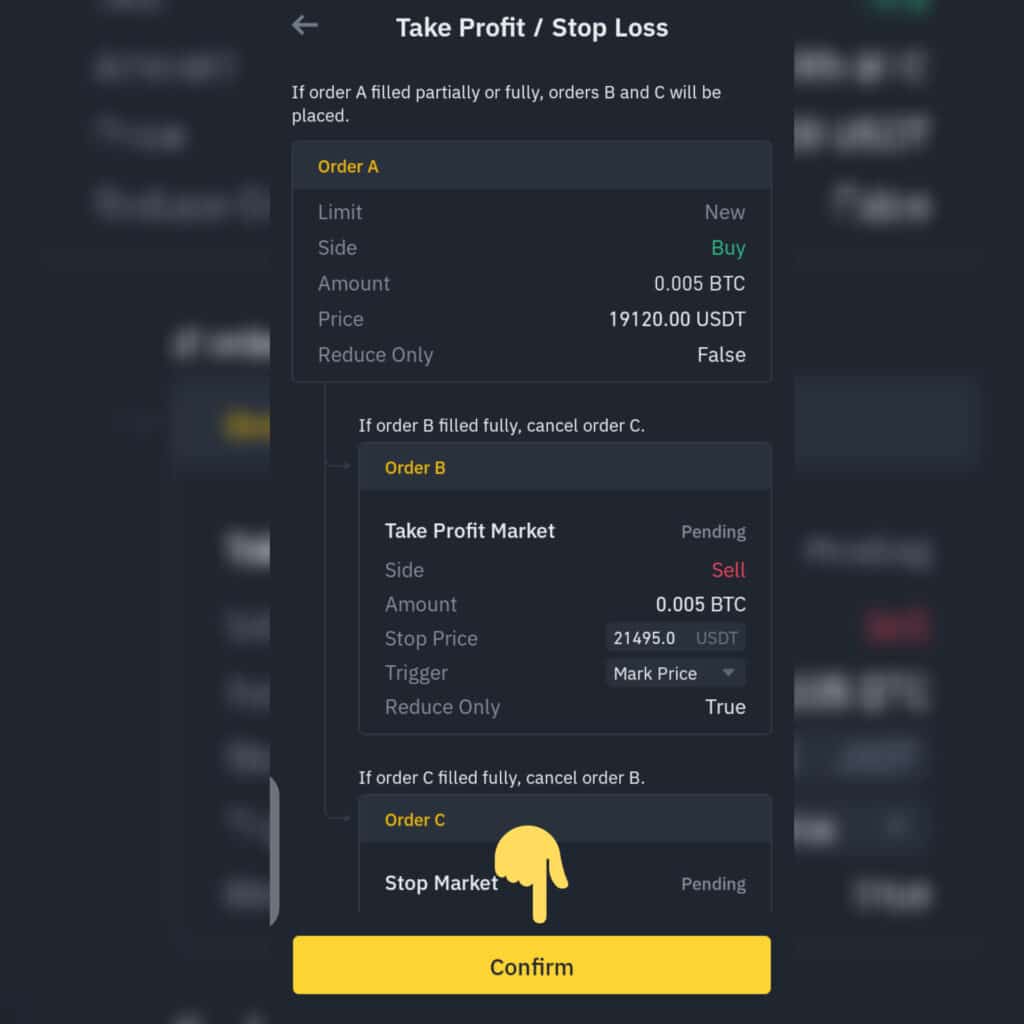

The screenshot below shows all the rules that bind this LONG Order, that is, if the Order A (which is Entry Price) triggers.

Then both Order B(the Take Profit Price) and the Order C (which is the Stop Loss Price) are also placed or queued, but…

One of the two orders B and C will be fulfilled if Order A is triggered.

If Order A (Entry Price) is filled and Order B (Take Profit Price) also gets triggered then Order C (Stop Price) is cancelled.

This means the position closes with your Profit Target – You Win! But…

If the Order A (Entry Price) gets filled but the Order C (Stop Loss Price) is triggered, then Order C which is Stop Loss cancels Order B which is the Take Profit Order. And…

This means that the LONG Position is terminated with some little losses to prevent further losses and potential liquidation.

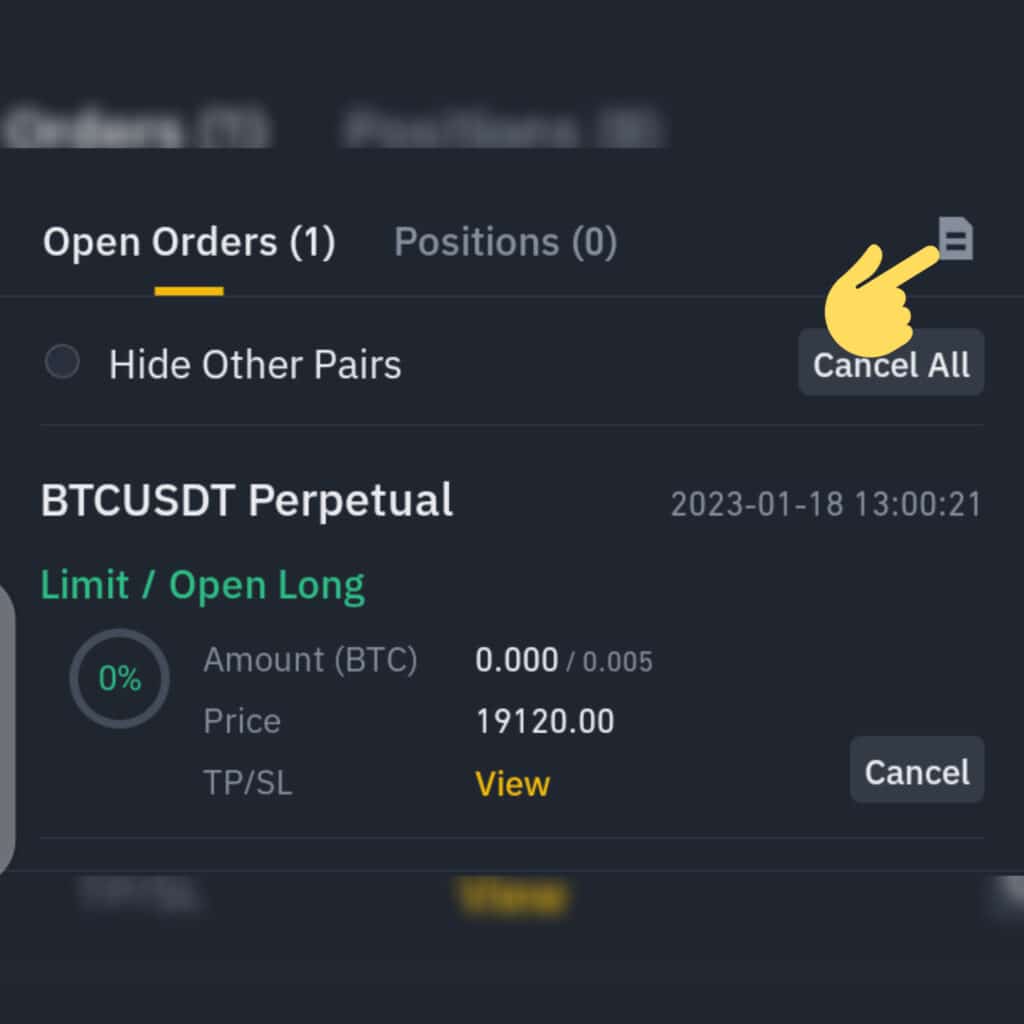

Next, let me show you where you can find all your open orders and trade history easily. See the Screenshot below;

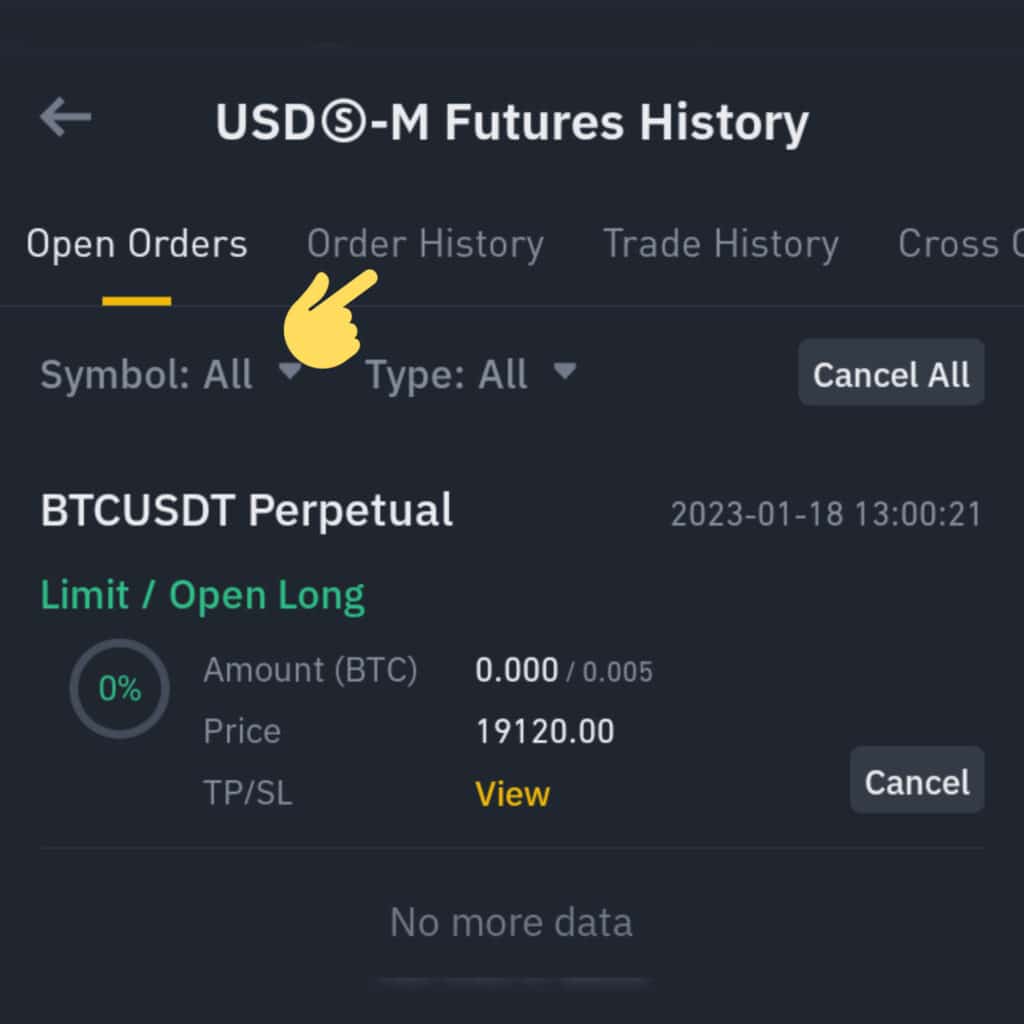

See the screenshot below to see the next page after you have clicked on the little page icon;

Finally, you need to know how to check your Futures Wallet Profit/Loss and Total Balance. Follow the instructions in the screenshot below;

Go back to the Binance homepage and click on WALLET then, click on FUTURES button at the top to the right as seen in the screenshot below;

Important Tips to Put at the Back and Front of Your Mind!

Note: Before you start trading Futures Contract on Binance..

You must have some knowledge of Technical Analysis (T.A) that will help you determine your Entry and Exit Points, Take Profits (TP) and Stop Loss (SL) targets. Or..

You need to have someone who you trust that is providing you with a trading signal you can use to trade on Futures.

Like I told you earlier, I send FREE Trading Signals like a couple of times or more weekly on Whatsapp for my community.

You need either of the two methods to trade Futures Contract on Binance but…

Most importantly, you need to understand trading psychology to be profitable and…

I advise you NOT to trade with any money you need urgently or that you can’t afford to lose as this will lead to trading with emotions and that’s not all…

Do not use high leverage especially when you’re just starting to trade on Futures.

It’s like you learning to drive a car and instead of going slowly and stepping on the throttle gently…

You decide to long step on the throttle and begin over-speeding, you know what’s going to happen right?

You’re definitely heading for a crash with high leverage which we call getting rekt in Crypto (liquidation) but…

Whichever way you go with the two options above..

I still recommend that you discover how to trade yourself by investing your time to watch FREE YouTube videos or..

Invest your money to buy books or take some T.A courses on it.

Which is better to you, getting free signals once or twice a week or you can go to the pond and kill enough fishes yourself everyday or anytime you really want to eat fish?

I also need to tell you that…

While you consider my recommendation on learning to trade yourself, you need to have a lot of patience for your growth to happen.

Rome is NOT built in a day…

Many times you will make mistakes, burn your money and take really bad decisions in the market that might cost you. But…

That’s completely fine, because it’s all part of the process and that’s what make the hero out of you.

This is why it’s important to learn from other Traders who have cracked the codes as this will reduce your learning curve and increase your profit margin.

Another important thing I will recommend you do is to listen to news on Crypto and financial markets generally as all these also have impacts on the market.

although, all of that will reflect in the charts if you understand how to read it, but..

Staying current with the news and getting updated will allow you get positioned to be profitable with it instead of the market going against you.

Example of that is the news about $LUNA and $FTT (of FTX) crash..

Some people who got the speculation earlier enough found a SHORT entry and made cool profits from it while many lost a lot of money through it.

As you can see here…

Cryptocurrency is a volatile market in general but you decide whether you want to profit from the volatility or the other way round with your decisions.

Finally, another thing I need to tell you is that, in this space you need to TAKE RESPONSIBILITY for whatever actions you take.

You don’t blame anyone for losing money or for making profits.

This is why, you will see the acronym DYOR on most Crypto content which stands for Do Your Own Research.

After someone provides you with an information..

It’s your sole responsibility to research it out (that’s why it’s called RE-search), agree to it and take full responsibility for the outcomes either positive or negative.

And after all being said, it’s time to put this article to close as I do the summary next.

Next Read: Trading Psychology – Lessons of Jesse Livermore

Summary – Time to Relax and Rest Your Back!

I have been able to do justice to the 7 most important complex terminologies of Futures Contract and made it easily understood..

You have discovered why you need to start trading Futures Contract on Binance as a Crypto Holder as well and..

I have revealed to you how to trade Futures on Binance with a step by step method.

Plus I have uncovered many important tips you need to be abreast of in this Crypto and web3 space.

If this is your first time of hearing about Cryptocurrency or..

You want to start from the beginning, I also have you in mind. Read my next sentence below..

I have prepared a well detailed article for you on everything you need to know on Cryptocurrency and how to make money trading Bitcoin or alternatives to Bitcoin (Alts).

To begin reading, just click here now.

If you don’t have a Binance account yet, this is the right time to create one.

You can use my Binance Affiliate Link to register an account on Binance and get $100 Welcome Bonus plus 10% LIFETIME DISCOUNT on all your trades.

Wait, there is more..

For using my Affiliate link to register on Binance, you also get access into my inner circle plus One on One Support on Whatsapp and through E-mail.

Go ahead and register on Binance NOW and have access to all your rewards.

If you are already into Crypto but you would like to start trading Futures Contract on Binance as a Crypto Holder..

You can register with my Affiliate Link too and get good DISCOUNT and low trading fees on all your trades.

Binance is the #1 leading exchange in the world, you can begin trading Futures Contract on Binance with my Affiliate Link immediately, click here to get started NOW.

It’s not whether you’re right or wrong, but how much money you make when you’re right and how much you lose when you’re wrong.

― George Soros

Your Opinion Matters – Write Me Your Feedback (I reply All Comments)

I know it has been a long ride with me and I believe you have gotten value from this new article.

If so, let me know what you think about this article..

Leave me your most TAKE AWAY, drop me your opinion, question or any enquiry and I will definitely reply to your comment as fast as possible.

Also, please feel free to SHARE this content with your fams and frens and anyone you know this article will help.

When you do this, you are also contributing your quota to this ecosystem and..

Together we can drive the Crypto/Bitcoin adoption and onboard more users to the web3 space.

Thank you for reading.

Wish you all the best!

If we ain't talking profits, then we ain't talking!

This article and every other information on this website are for educational and information purposes ONLY. They should NOT be treated as investment, financial, or trading advices or any other advices.

All rights reserved. This material and any other digital content on this website should NOT be reproduced, published, broadcast, written or distributed in full or in part, without written permission from PROFITSTALKING owner.

Wow, this is awesome.

One thing that keeps me glued to your articles is the way you simplify whatever you’re talking about.

This article above is a very detailed one.

It was as if you physically took me on a walk with you😁😁

Thanks for taking your time to help and impact others.

Keep up the good work

Hi Toluwani,

Thanks for stopping by to let me know how simple and detailed you found the article.

Of course, it’s my mission to walk you hand in hand in the post because I had you in mind as a beginner.

I’m glad you enjoyed the content. Thanks for your feedback.

Great article Mike.

This is a thorough and helpful article for the rest of us who are stepping into the crypto space.

Well explained and easy to read.

I believe Binance is a great platform for trading.

What about platform like Olymptrade?

Looking forward for your next article

Hi Sebastian,

Thanks for your feedback. I am glad you found the content helpful and easy to read.

Yeah, Binance is a great platform and the #1 biggest exchange in the world with simple User Interface (UI) and ease of things brought to Crypto.

These are part of the reasons I love promoting Binance since 2 years ago even before I became an Affiliate with them.

About the Olymptrade you mentioned, I don’t know much about them at the moment, but I could research it out later for future articles. But..

I’m of the opinion that, Binance provides everything you need in Crypto and Blockchain industry whether you’re an Investor or a Trader.

If there is anything else you need to know about Binance, you can shoot me an email or leave it under the comment here.

I will reply to it as soon as possible.

Thanks once again for your feedback.

Amazing

Hi Chukwu glad you found it amazing, thanks for engaging.

Wow!!!

This article is just out of the world!!

This article open my eyes to something I think I knew about future contract trading while I didn’t.

especially the stop limit order and the trigger

The more you consume proven materials the more you know.

Mike, thanks for putting this out. I’m sure this will benefit not just beginners but crypto PRO as well

Well tailored!

Hi Hassan,

Glad you discovered something new from the content.

Yeah, that is how it works, consuming content like this gives you more knowledge about the Crypto Trading and more..

Thanks for taking your time to write me your feedback.

This is detailed enough for anybody planning to explore future trading.

It’s an honour to learn from you sir.

We look forward to more of this from you.

Best regards

Crystalpay

Hi Crystalpay,

Thanks for your feedback, I’m glad you found value from the content.

Of course, it’s my pleasure to share my knowledge with you and I promise to do more of this for you and the community.

Thanks for stopping by.

Hi.

Thanks for the nice explaination. It helped me a lot.

I got one question that confuses me:

I have 50USDT in my Future Wallet and Go Long with 10x. Why is the PNL calculated only with my 50USDT? Should it not be calculated with 500USDT? I don´t get it. Is there anything i am doing wrong or do i not understand it correctly. Thanks for your help.

Hi George,

Glad that the content was helpful to you.

To your question..

With your explanation, you said;

You have $50 USDT in your Futures Wallet and Go Long with 10x.

Now, before I show you how to calculate your PNL.

You need to understand something…

Your profit/loss is calculated with your leverage (10x here).

That is why you make more money with leverage if things go your way and..

You also make more loses if your stop loss is hit and your trade strategy is invalidated.

Now, pay attention carefully and stay with me as I explain it to you in details;

Your $50 is your total available balance and to Go Long you will need to use some percentage out of it as your Initial Margin.

For the sake of explanation;

Let’s say you used 50% of your Total Balance of $50 to Go Long which is $25 with 10X Leverage(too much though, use lesser percentage but with more funds!)

Now, $25 is your Initial Margin with Initial Margin Requirement(IMR) of 10%(10/100 = 1/10) which is also your Leverage(10x).

Now I will give you the FORMULA to calculate your LONG and SHORT Profits next:

Long Profit Formula = [(1/Entry Price) – (1/Exit Price)] * Position Size

Position Size = Initial Margin * Leverage

Final Profit Formula:

After you’ve gotten the Long Profit Formula(let’s call it LPF in short form)..

You will now use this formula below to get your Profit Value Back in USDT;

Your Long Profit = LPF * Entry Price

Let’s use one example to see how it works in details;

Now, let’s use OCEAN/USDT as an example, you can use this formula for any asset.

Entry Price = 0.30860

Exit Price = 0.31993

Position Size = $250 (as calculated above)

Let say we want to LONG OCEAN/USDT, then let’s use all these values in the formula now;

LPF = [(1/0.30860) – (1/

0.31993)] * 250

LPF = [(3.24044 – 3.12568)] * 250

LPF = (0.11476) * 250

LPF = 28.69

Now, to get your Final Long Profit back in USDT, we use this Formula;

Your Long Profit = LPF * Entry Price

Your Long Profits = 28.69 * 0.30860

Long Profits = $8.85373

Your Long Profits for this leveraged Position above is $9 approximately to 1.s.f.(One Significant figure)

In this same way, let’s say you want to open a SHORT Leveraged Position using the same values as above but…

Since we’re Shorting now, the Exit Price will come first before the Entry Price. And..

And also, I’m going to interchange the values since we’re SHORTING.

The SHORT Formula goes thus;

Long Profit Formula = [(1/Exit Price) – (1/Entry Price)] * Position Size

Position Size = Initial Margin * Leverage

Here are our values for this OCEAN/USDT SHORT Position using the same Leverage and Initial Margin as in Long Position:

Entry Price = 0.31993

Exit Price = 0.30860

Position Size = $250 (as calculated above)

Since we’re Shorting OCEAN/USDT, then let’s use all these values in the formula now;

LPF = [(1/0.30860 – (1/

0.31993)] * 250

LPF = [(3.24044 – 3.12568)] * 250

LPF = (0.11476) * 250

LPF = 28.69

Now, to get your Final Short Profit back in USDT, we use this Formula;

Your Short Profit = LPF * Entry Price

Your Long Profits = 28.69 * 0.31993

Short Profits = $9.17879

Your Short Profits for this leveraged Position is $9 approximately to 1.s.f.(One Significant figure)

Now, that’s how to calculate your LONG and SHORT Profits but…

If you find that method stressful, you can use the Binance Calculator inside the Futures Account to calculate your PNL.

To get the Calculator, from your Futures Homepage inside the Binance App, click on the icon beside the chart(candles) patterns icon at the top right corner and the Calculator will be opened for you.

To use the Binance Calculator, you need these values below;

Initial Margin, Entry Price, Exit Price and Quantity.

I know it might be difficult to get the value of your Quantity of the Order.

So, I used the change of Formula method to get it for you.

See the formula below;

Initial Margin = Quantity * Entry Price * IMR

Note: IMR = 1/Leverage (i.e 1/10)

Using the Change of Formula method;

Quantity = Initial Margin / (Entry Price * IMR)

So, you can go ahead and supply that Formula to get the Quantity of any asset you want to LONG or SHORT to calculate your PNL using the Binance Futures Calculator.

Try it and let me know if you get it and if you have any more questions..

Leave it for me here, I will reply as soon as possible.

I hope this explanation is simple for you to understand.

Boss, this is a scintillating article on futures trading. Keep it up bro.

Hi Abolurin,

Thanks for your feedback. Glad you love the content.